Buying Insurance Online vs Agent? Complete Information

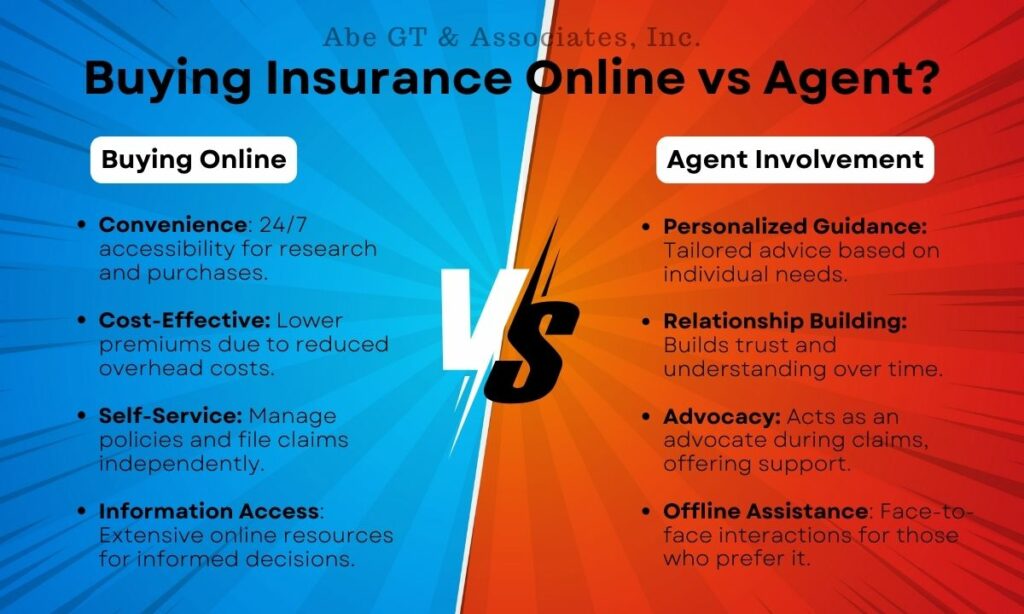

Today, everything is digital, from buying daily supplies to insurance. While purchasing insurance online offers convenience and allows for easy policy comparisons, purchasing through an agent provides personalized guidance, tailored coverage, and claims assistance. Let’s break down the process of buying insurance online versus through an agent to help you choose your preferred medium.

Buying Insurance Online

Buying insurance online offers convenience and accessibility. You can explore various policies, compare quotes, and make decisions at your own pace. However, you would need to double-check the accuracy of all information and understand the terms. At times, this can be a challenge when you can’t clarify your confusion with a person physically right away.

Similarly, you need to select a reliable online platform to ensure a smooth and secure insurance purchase. Although most online insurance websites are authentic, it is advisable to limit your search to company-specific platforms like Progressive, All-State, etc. to ensure safety.

Also Read: How to Renew Your Car Insurance

Buying Insurance from Agent

Buying insurance from an agent can offer a more tailored approach. An agent can assess your specific needs, explain different policies and their details, and guide you through the process directly, without any intermediary. With an agent, you can receive direct support and advice tailored to your circumstances.

Some people feel limited when it comes to buying insurance offline because they are restricted to only the agents in their community or surrounding area. However, you can easily search for licensed insurance agents near you and submit your request on their website, or better, you can call them directly to get the information you need.

Difference Between Online Vs Agent

The method of purchasing insurance, whether online or through an agent, does not impact the quality of coverage. However, the experience of buying insurance differs between the two methods.

The primary difference lies in the level of assistance, personalization, and speed. While online purchases offer quick comparisons, agents provide a more comprehensive comparison by considering your specific needs and providing a personalized experience. When buying insurance online, the entire process is self-service, and you are responsible for all the comparisons yourself. In contrast, the process may be slower with an agent, but you only need to provide your requirements, and the agent will handle the paperwork for you.

It’s a matter of choosing between self-service efficiency and individualized support.

Whether you are looking to buy insurance online or from an agent, Abe GT & Associates affirms our commitment to being your premier choice for delivering you a suitable insurance policy. Give us a call or drop your requirements on our contact form to get quotes for coverage.

Also Read: How to File a Homeowner Insurance Claim in 2024

FAQs

Is it cheaper to buy insurance online?

Buying insurance online sometimes proves to be cheaper due to reduced overhead costs for the insurance provider including agent commissions and administrative expenses. But you may end up buying an insufficient policy.

How do I find a trustworthy insurance agent?

The first thing to do is to look for a licensed insurance agent. Ask the right questions regarding their years of experience. You can also ask your friends and family for recommendations or peruse online reviews.

Are there any processing fees that come with purchasing insurance online?

Depending on the platform, some may charge while others may not. Carefully review the policy documents, terms, and conditions to identify potential processing fees.

Even when purchasing insurance online, can you still speak with an agent physically?

Many online insurance platforms provide the option to speak with anagent physically It is often done through phone, chat, or email.

How do I find a reputable insurance company online?

Do a Google search or look on platforms like Yelp. Look at their customer reviews, agency ratings, recommendations, or licensing verification.